Chase Closing Cost Assistance: The Ultimate Guide To Saving Big On Your Dream Home

Buying a home is one of the biggest financial decisions you'll ever make, but it comes with plenty of hidden costs—especially closing costs. Luckily, Chase Closing Cost Assistance is here to help ease the burden. Whether you're a first-time homebuyer or a seasoned homeowner, understanding this program can save you thousands of dollars. So, let's dive in and break it all down for you!

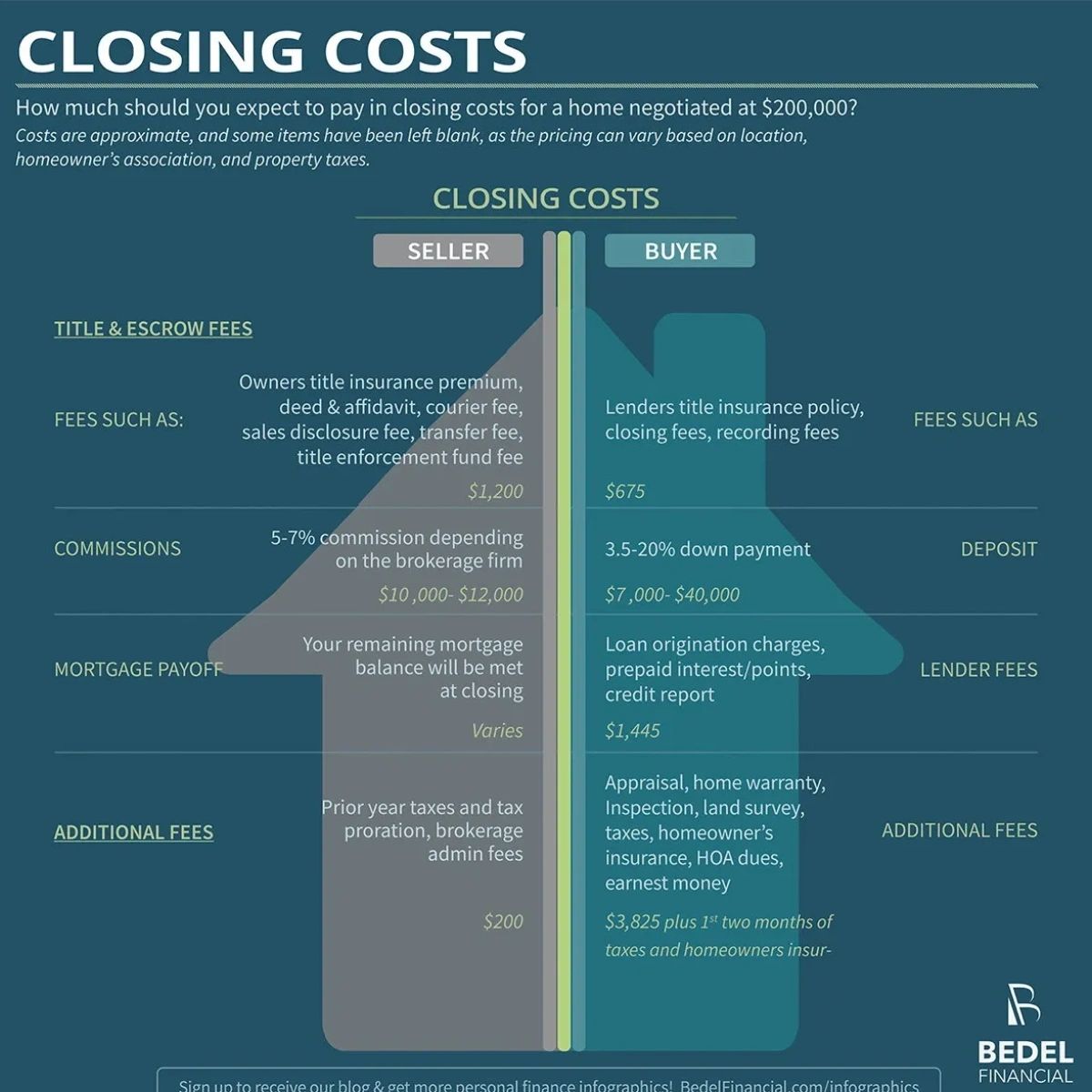

When you're shopping for a mortgage, it's easy to get overwhelmed by all the fees and charges that pop up along the way. Closing costs alone can range anywhere from 2% to 5% of the home's purchase price. That's where Chase steps in with its Closing Cost Assistance program. This isn't just some fancy marketing gimmick—it's a real deal designed to help borrowers like you manage those hefty expenses.

Now, before we go any further, let me tell you something important: Chase isn't just handing out money for free. There are rules, qualifications, and conditions you need to meet. But don't worry—we're about to unpack everything so you'll know exactly what to expect. By the end of this guide, you'll have a clear roadmap to take advantage of this amazing opportunity. Let's get started!

What Is Chase Closing Cost Assistance?

Chase Closing Cost Assistance is essentially a financial perk offered by JPMorgan Chase to eligible borrowers who opt for certain types of mortgages. It's like a helping hand that says, "Hey, we know closing costs can be brutal, so here's a little something to make it easier." Think of it as a rebate or discount on your closing costs, which can add up to thousands of dollars depending on the size of your loan.

This program is available for both purchase loans and refinances, though the specifics may vary based on your situation. For instance, if you're buying a new home, Chase might cover a portion of the upfront fees associated with processing your mortgage. If you're refinancing, they could help reduce the costs tied to re-evaluating your property. Either way, it's a win-win situation for anyone looking to save money.

How Does It Work?

The process is pretty straightforward once you understand the basics. When you apply for a mortgage through Chase, your loan officer will assess whether you qualify for the Closing Cost Assistance program. If you do, they'll apply the discount directly to your closing statement, reducing the amount you need to pay out of pocket.

- Step 1: Apply for a mortgage with Chase.

- Step 2: Discuss eligibility for Closing Cost Assistance during the application process.

- Step 3: If approved, the assistance will automatically be applied to your closing costs.

It's worth noting that this assistance isn't a standalone program. Instead, it's often bundled with other mortgage products or promotions, such as fixed-rate loans or adjustable-rate mortgages. So, make sure to ask your loan officer about all the available options when you're shopping around.

Who Qualifies for Chase Closing Cost Assistance?

Not everyone qualifies for Chase's Closing Cost Assistance, but the good news is that the requirements aren't as strict as you might think. Generally speaking, you'll need to meet the following criteria:

- Be applying for a Chase mortgage (purchase or refinance).

- Meet income guidelines and credit score requirements.

- Be purchasing or refinancing a primary residence, second home, or investment property.

- Work with a Chase-approved loan officer.

There are also some location-specific restrictions, so if you're buying a home in a rural area or a high-cost market, it's worth double-checking whether the program applies to you. Additionally, Chase tends to favor borrowers who demonstrate financial stability, so maintaining a solid credit history and steady employment can improve your chances of approval.

Key Eligibility Factors

Here's a closer look at the key factors that determine whether you qualify:

- Credit Score: While Chase doesn't publicly disclose exact credit score requirements, most borrowers will need a score of at least 620 to qualify for conventional loans.

- Debt-to-Income Ratio (DTI): Your DTI should generally be below 43%, although exceptions may apply in certain cases.

- Loan-to-Value Ratio (LTV): The LTV ratio depends on the type of property you're purchasing and the loan product you choose. For example, conventional loans typically require an LTV of 80% or less without private mortgage insurance (PMI).

Remember, these are just general guidelines. Your specific situation may vary, so it's always best to consult with a Chase loan officer to get a personalized assessment.

How Much Can You Save with Chase Closing Cost Assistance?

This is the million-dollar question, right? The exact amount you can save with Chase Closing Cost Assistance varies depending on several factors, including the size of your loan, the type of property you're purchasing, and the specific terms of your mortgage. On average, borrowers can expect to save anywhere from $1,000 to $5,000 or more.

For example, let's say you're buying a $300,000 home and your closing costs come out to 3% of the purchase price, which equals $9,000. If Chase covers 50% of those costs, that's a savings of $4,500 right off the bat. Not bad, huh?

Real-Life Examples

Let's break it down with a couple of real-life scenarios:

- Scenario 1: John is refinancing his $250,000 home. His closing costs total $7,500, but Chase offers him a 40% discount, saving him $3,000.

- Scenario 2: Sarah is purchasing her first home for $400,000. Her closing costs amount to $12,000, but Chase knocks off 60%, saving her a whopping $7,200.

As you can see, the savings can add up quickly, making Chase Closing Cost Assistance a no-brainer for many borrowers.

Benefits of Using Chase for Your Mortgage

Aside from the Closing Cost Assistance program, Chase offers plenty of other perks that make it an attractive choice for homebuyers. Here are just a few:

- Competitive Interest Rates: Chase frequently offers some of the lowest rates in the industry, which can save you thousands over the life of your loan.

- Flexible Loan Options: Whether you're looking for a fixed-rate mortgage or an adjustable-rate mortgage, Chase has something for everyone.

- Excellent Customer Service: Chase is known for its top-notch customer support, ensuring a smooth and stress-free experience from start to finish.

Plus, as a major financial institution, Chase has the resources and expertise to guide you through every step of the homebuying process. From pre-approval to closing, you'll have access to knowledgeable loan officers who can answer all your questions and address any concerns you may have.

Common Misconceptions About Chase Closing Cost Assistance

There are a few misconceptions floating around about Chase Closing Cost Assistance that we need to clear up:

- Myth #1: "It's only for first-time homebuyers." Actually, Chase offers this assistance to all eligible borrowers, regardless of whether it's your first home or your fifth.

- Myth #2: "You have to pay it back later." Nope! The assistance is a one-time discount that doesn't need to be repaid.

- Myth #3: "It's too good to be true." Trust us—it's real. Just make sure you meet the eligibility requirements and work closely with your loan officer to secure the benefits.

Now that we've debunked those myths, let's move on to some practical tips for maximizing your savings with Chase.

Tips for Maximizing Chase Closing Cost Assistance

Here are a few strategies to help you get the most out of Chase's Closing Cost Assistance program:

- Shop Around: Compare Chase's offerings with other lenders to ensure you're getting the best deal possible.

- Ask Questions: Don't be afraid to grill your loan officer about all the available discounts and promotions.

- Stay Organized: Keep track of all your documents and deadlines to avoid any last-minute surprises.

By doing your homework and staying proactive, you can ensure that you're taking full advantage of everything Chase has to offer.

Final Thoughts

Chase Closing Cost Assistance is a fantastic resource for anyone looking to save money on their home purchase or refinance. Whether you're a first-time homebuyer or a seasoned pro, understanding this program can make a huge difference in your financial journey. So, what are you waiting for? Reach out to a Chase loan officer today and start exploring your options!

Conclusion

In summary, Chase Closing Cost Assistance is a game-changer for homebuyers and refinancers alike. By reducing the upfront costs associated with closing a mortgage, this program makes homeownership more accessible and affordable for millions of Americans. Just remember to review the eligibility requirements carefully and work closely with your loan officer to ensure you're getting the best deal possible.

Now, it's your turn! Leave a comment below and let us know if you've taken advantage of Chase's Closing Cost Assistance program. Or, share this article with a friend who might benefit from the information. Together, we can help more people achieve their homeownership dreams!

Table of Contents

- What Is Chase Closing Cost Assistance?

- Who Qualifies for Chase Closing Cost Assistance?

- How Much Can You Save with Chase Closing Cost Assistance?

- Benefits of Using Chase for Your Mortgage

- Tips for Maximizing Chase Closing Cost Assistance

- Common Misconceptions About Chase Closing Cost Assistance

Down Payment & Closing Cost Assistance Programs

This Organization Is Helping To Pay Closing Fees For Homebuyers As

Closing Cost Chart STL Mortgage Solutions