1099 Form Colorado: Your Ultimate Guide To Tax Filing In The Centennial State

Let’s face it, tax season can be a headache—but it doesn’t have to be. If you’re an independent contractor or freelancer in Colorado, understanding the 1099 form is crucial for staying compliant with state and federal tax laws. Whether you’re new to the gig economy or just need a refresher, this guide has got you covered. So grab a cup of coffee, sit back, and let’s dive into everything you need to know about the 1099 form Colorado style.

Tax forms might sound boring, but trust me, they’re kinda like the unsung heroes of your financial life. The 1099 form is one of those tools that helps freelancers and contractors keep track of their income. In Colorado, where the economy is booming with small businesses and side hustlers, mastering this form can save you from penalties and headaches down the road.

Now, I know what you’re thinking—“Do I really need to learn all this?” Short answer? Yes. Long answer? Absolutely yes. The 1099 form isn’t just some random piece of paper; it’s your ticket to proving how much you earned and ensuring you pay the right amount of taxes. So, let’s break it down step by step and make sense of this whole tax filing process.

What is a 1099 Form?

Alright, let’s start with the basics. A 1099 form is essentially a tax document that reports payments made to individuals who aren’t traditional employees. If you’re a freelancer, consultant, or independent contractor, chances are you’ve received one of these babies at some point. But here’s the deal: there are different types of 1099 forms, each serving a specific purpose.

For example, if you’ve earned income from non-employee work, you’ll likely get a 1099-NEC. If you’ve received interest or dividends, you might see a 1099-INT or 1099-DIV. And guess what? Colorado cares about all of it. The state wants to make sure everyone pays their fair share, so understanding which form applies to you is key.

Why Does Colorado Care About the 1099 Form?

Colorado has its own set of tax rules, and the 1099 form plays a big role in ensuring compliance. The Centennial State uses the information reported on these forms to verify that residents are paying the correct amount of state income tax. If you fail to report your 1099 income, you could face penalties, interest charges, and even audits. Yikes.

But here’s the good news: Colorado offers resources to help you navigate the process. From online filing options to tax assistance programs, the state is committed to making tax season less painful for everyone.

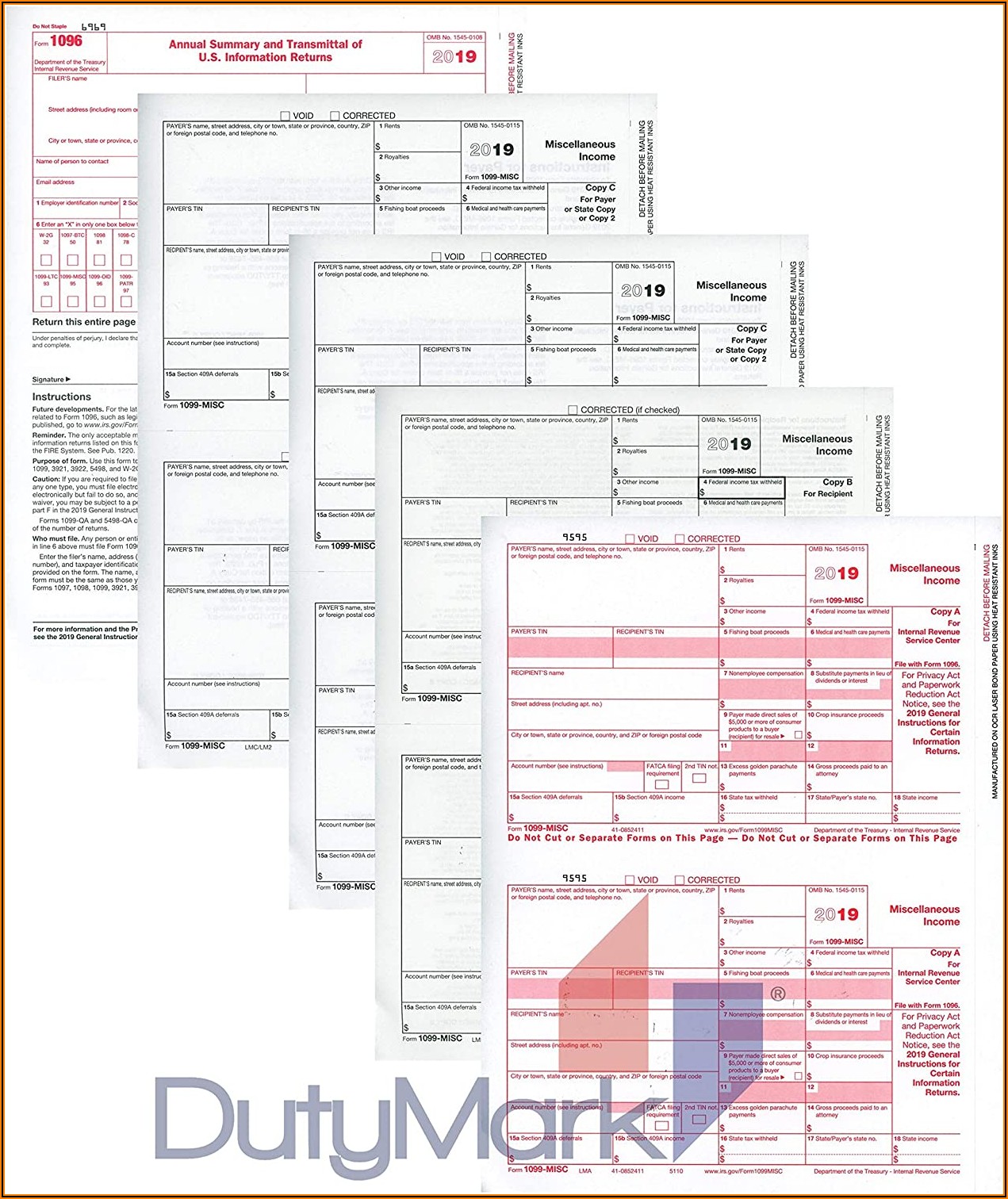

Types of 1099 Forms in Colorado

Not all 1099 forms are created equal. Here’s a quick rundown of the most common types you might encounter:

- 1099-NEC: For non-employee compensation, like freelance work or consulting gigs.

- 1099-MISC: For miscellaneous income, such as rent payments or prize winnings.

- 1099-DIV: For dividends and distributions from investments.

- 1099-INT: For interest income from banks or other financial institutions.

- 1099-R: For retirement plan distributions, like withdrawals from IRAs or pensions.

Each form serves a unique purpose, so it’s important to understand which one applies to your situation. And if you’re unsure, don’t hesitate to consult a tax professional or use online resources to clarify things.

How to File a 1099 Form in Colorado

Filing a 1099 form in Colorado can be done either electronically or by mail. Most people opt for electronic filing because it’s faster and more convenient. Plus, you’ll receive confirmation that your forms were successfully submitted.

Here’s a quick checklist to help you file your 1099 form:

- Gather all necessary documents, including your Social Security Number or EIN.

- Double-check the accuracy of the information on your forms.

- Submit your forms by the deadline, which is usually January 31st for federal reporting and February 28th for state reporting.

- Keep copies of all submitted forms for your records.

Pro tip: Use IRS-approved software or platforms to streamline the process. Many of these tools are compatible with Colorado’s tax system, making it easier to file both state and federal forms simultaneously.

Common Mistakes to Avoid When Filing a 1099 Form

Mistakes happen, but when it comes to tax forms, they can be costly. Here are some common pitfalls to watch out for:

- Missing deadlines: Late filings can result in penalties, so make sure you submit everything on time.

- Incorrect information: Double-check names, Social Security Numbers, and payment amounts to avoid errors.

- Forgetting to file state forms: Colorado requires separate filings, so don’t overlook this step.

- Not keeping records: Always maintain copies of your forms in case you need to reference them later.

By staying organized and attentive, you can avoid these mistakes and ensure a smoother filing experience.

Understanding Colorado’s Tax Rates for 1099 Income

Colorado has a flat income tax rate of 4.55%, which applies to all residents regardless of income level. This means that any 1099 income you earn will be taxed at this rate. However, keep in mind that federal taxes and potential deductions can also impact your overall tax liability.

For example, if you earned $50,000 in 1099 income, you’d owe approximately $2,275 in state taxes. But if you qualify for deductions like home office expenses or business-related travel, your taxable income could decrease significantly.

How to Calculate Your 1099 Taxes in Colorado

Calculating your taxes might seem intimidating, but it’s actually pretty straightforward. Start by adding up all your 1099 income from various sources. Then, subtract any eligible deductions to determine your taxable income.

Here’s a simple formula to follow:

Total 1099 Income - Deductions = Taxable Income

Once you’ve calculated your taxable income, apply Colorado’s 4.55% tax rate to figure out how much you owe. Remember, this is just a rough estimate. For a more accurate calculation, consider using tax software or consulting a professional.

Top Deductions for 1099 Filers in Colorado

Deductions can make a big difference in reducing your tax bill. Here are some of the most popular deductions for 1099 filers in Colorado:

- Home office expenses

- Travel and transportation costs

- Health insurance premiums

- Retirement contributions

- Education and training expenses

By taking advantage of these deductions, you can lower your taxable income and keep more money in your pocket.

When Do You Need to Issue a 1099 Form in Colorado?

If you’re a business owner in Colorado and you’ve paid someone $600 or more during the year, you’re required to issue a 1099 form. This includes payments to contractors, freelancers, and other non-employees. Failure to issue a 1099 form can result in penalties, so it’s important to stay compliant.

Here’s a quick guide to help you determine when to issue a 1099 form:

- Payments made to individuals for services rendered.

- Rent payments exceeding $600.

- Prizes or awards worth $600 or more.

- Interest or dividend payments exceeding $10.

Remember, the rules can vary depending on the type of payment and the recipient, so always consult the IRS or Colorado Department of Revenue for clarification.

Tips for Staying Organized During Tax Season

Tax season can get chaotic, but with the right tools and strategies, you can stay organized and stress-free. Here are some tips to help you manage your 1099 forms:

- Use a dedicated folder or app to store all your tax documents.

- Set reminders for important deadlines.

- Keep track of your income and expenses throughout the year.

- Consider working with a tax professional to simplify the process.

By staying organized, you’ll save yourself time and headaches when it comes to filing your taxes.

Conclusion: Mastering the 1099 Form Colorado Style

So there you have it—everything you need to know about the 1099 form in Colorado. Whether you’re a freelancer, business owner, or just trying to navigate the gig economy, understanding this form is essential for staying compliant and avoiding penalties.

Remember, the key to success is staying informed and organized. Use the tips and resources provided in this guide to streamline your tax filing process and make the most of your 1099 income.

And hey, don’t forget to share this article with your friends and colleagues who might find it helpful. Or better yet, leave a comment below and let us know your thoughts on tax season in Colorado. Together, we can make sense of this whole tax thing and keep our wallets happy.

Table of Contents

- What is a 1099 Form?

- Why Does Colorado Care About the 1099 Form?

- Types of 1099 Forms in Colorado

- How to File a 1099 Form in Colorado

- Common Mistakes to Avoid When Filing a 1099 Form

- Understanding Colorado’s Tax Rates for 1099 Income

- How to Calculate Your 1099 Taxes in Colorado

- When Do You Need to Issue a 1099 Form in Colorado?

- Tips for Staying Organized During Tax Season

- Conclusion: Mastering the 1099 Form Colorado Style

Colorado 1099 Form Form Resume Examples edV1pPlBYq

Colorado 1099 Transmittal Form Form Resume Examples kLYrKG17V6

N 1099 Printable Form Colorado Printable Forms Free Online