Easy Investment Management: Stocks, ETFs & Retirement Planning

Are you truly in control of your financial destiny? Taking charge of your investments, from stocks and ETFs to mutual funds and CDs, is not just a possibilityit's a necessity for securing your future, and it's more accessible than you think, especially with the free resources available to guide you.

A well-constructed retirement income plan is the cornerstone of a worry-free future. It's not just about accumulating wealth; it's about crafting a strategy that delivers predictable income streams, fosters growth potential, and provides the flexibility to adapt to life's ever-changing circumstances. We believe a solid retirement income plan should provide 3 things: Predictable income from social security, pensions, and/or annuities to ensure core expenses are covered; Growth potential from investing a portion of savings to meet discretionary spending and legacy goals; Flexibility to refine your plan as needed over time.

| Category | Details |

|---|---|

| Name | Sham Ganglani |

| Position | Director of Retirement Product Management, Fidelity Investments |

| Career Highlights | Leads the development and management of retirement products at Fidelity, focusing on innovative solutions to help individuals achieve their retirement goals. Extensive experience in financial services, specializing in retirement planning and investment strategies. |

| Professional Focus | Retirement income planning, product development, investment management |

| Company | Fidelity Investments |

| Website | Fidelity Investments |

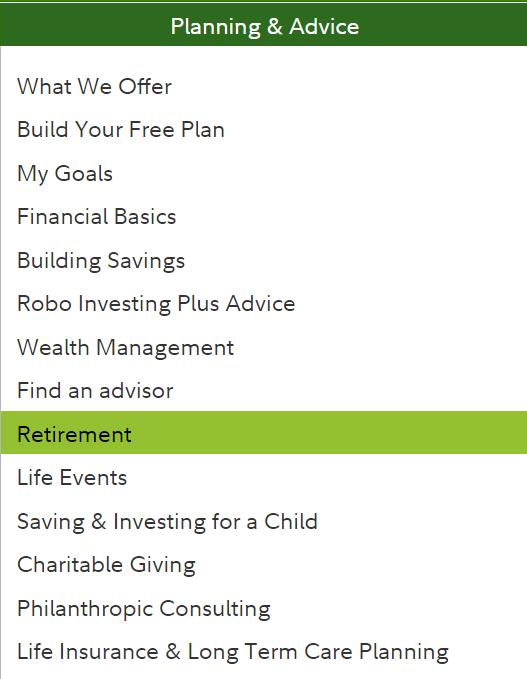

Retirement Planning Fidelity Investments Canada

Retirement Planning Fidelity Investments Canada

Fidelity Retirement Planning Tool High Level Model, Not Tactical