Retirement Planning: Manage Investments & Secure Your Future!

Are you truly in control of your financial future, or are you simply hoping for the best? Taking charge of your own investments stocks, ETFs, mutual funds, CDs, and beyond is no longer a luxury, but a necessity for securing a comfortable retirement. And the best part? Free resources are available to guide you every step of the way.

A well-structured retirement income plan isnt just about accumulating wealth; it's about ensuring financial security and flexibility. A truly robust plan should encompass three core elements. First, it needs a foundation of predictable income, derived from sources like Social Security, pensions, and annuities, that reliably covers essential living expenses. Second, it must incorporate the potential for growth, achieved through strategic investment of a portion of your savings, enabling you to pursue discretionary spending and leave a lasting legacy. Finally, and perhaps most importantly, it needs to offer the flexibility to adapt and evolve as your needs and circumstances change over time. This adaptability is what transforms a static financial plan into a dynamic strategy for lifelong financial well-being.

| Category | Information |

|---|---|

| Name | Sham Ganglani |

| Title | Director of Retirement Product Management, Fidelity Investments |

| Career Highlights | Leads the development and management of retirement products at Fidelity Investments. Focuses on creating innovative solutions to help individuals achieve their retirement goals. Previously held various leadership roles in product development and financial planning. |

| Professional Focus | Retirement planning, product management, financial innovation |

| Company | Fidelity Investments |

| Website | Fidelity Investments Official Website |

Imagine a future where your retirement is everything youve dreamed of. That future can become a reality by enrolling in your employers retirement plan today and harnessing the full spectrum of benefits available to you. Your savings and investing roadmap can be meticulously crafted to navigate any curveball life throws your way, ensuring you stay on course toward your ultimate retirement aspirations. Fidelity is committed to providing clear and comprehensive guidance at every stage of your retirement planning journey.

New to Fidelity NetBenefits? Exploring your retirement plan has been streamlined with recent enhancements designed to make the process more intuitive and user-friendly. Remember that by using this website, you consent to the use of cookies as described in the site's policy. You have the power to adjust your cookie settings at any time if you do not agree with the policy.

Fidelity Brokerage Services LLC, a member of NYSE and SIPC, located at 900 Salem Street, Smithfield, RI 02917, provides brokerage services. Retirement savings options are available whether you work for, own, or are contemplating starting a small business. You have the option to create or access your free plan for the retirement you desire. Annuities can also play a vital role in your retirement plan, offering a blend of security and potential growth.

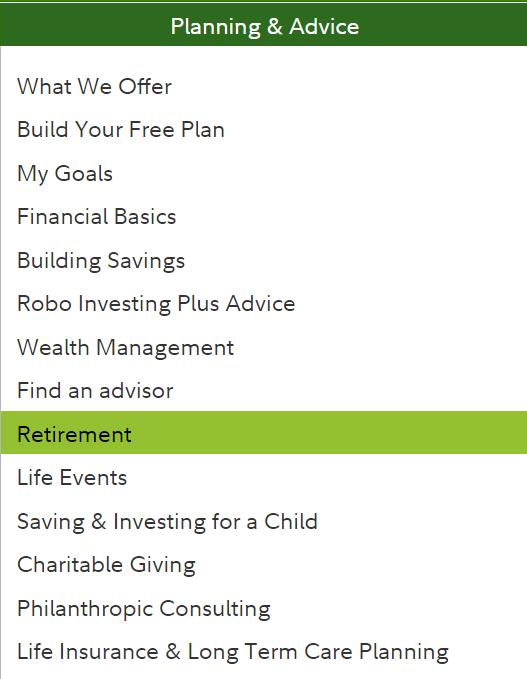

Estimate how much money you will need in retirement and how much you should save to reach that target. It is essential to invest for growth, always keeping your time frame, risk tolerance, and overall financial situation firmly in mind. Fidelitys Planning & Guidance Center is a valuable resource for building and monitoring your retirement plan, offering tools and insights to help you stay on track. You can also take advantage of Fidelity Smart Money, which provides insights into how news events can affect your finances, along with practical tips for spending, saving, and investing wisely.

Consider choosing one or more retirement plans that align with your specific needs and goals. For example, participating in your employers 401(k) plan allows you to contribute directly from your paycheck, making saving effortless. Setting up your retirement account can generally be done online, simplifying the process. You decide where you want your money to go, and typically, you will have a diverse range of investment options to choose from.

Before investing, carefully consider the funds' investment objectives, inherent risks, associated charges, and potential expenses. Contact Fidelity for a prospectus or, if available, a summary prospectus containing this crucial information. These documents provide a comprehensive overview of the fund, enabling you to make informed decisions. To learn more, you can also read Viewpoints on Fidelity.com, focusing on the three keys to your retirement income plan.

If you are considering rolling over funds from a former plan, start by contacting your previous plan provider to express your interest in transferring your funds to an IRA. Inquire about the specific process and requirements to ensure a smooth transition. According to Sham Ganglani, Fidelity Investments' Director of Retirement Product Management, "You're in the driver's seat," meaning you have the power to control your retirement savings.

Get the peace of mind that comes from financially protecting yourself and your family. Filling that gap can be accomplished in several different ways. Your primary resources will be your investment and retirement accounts, including taxable brokerage accounts, 401(k)s, traditional and/or rollover IRAs, and Roth IRAs. However, there are additional strategies to bolster your retirement income and offset challenging expenses.

Contact your old retirement plan provider to initiate the rollover process. Is your old retirement plan with Fidelity? If so, you can complete the entire rollover through your NetBenefits account. This streamlined approach requires no additional paperwork, and the money can be directly transferred. Visit NetBenefits (login required) to begin the process. If your old retirement plan is with a different provider, you will need to coordinate the rollover with them.

Fidelitys Planning and Guidance Center allows you to create and monitor multiple independent financial goals, providing a holistic view of your financial landscape. While there is no fee to generate a plan, standard expenses charged by your investments and other fees associated with trading or transacting in your account would still apply. It's important to note that the projections or other information generated by the Planning & Guidance Center retirement analysis, Fidelity Retirement Score, and retirement income calculator regarding the likelihood of various investment outcomes are hypothetical in nature and do not reflect actual investment results, nor are they guarantees of future results.

The rising cost of healthcare is a significant factor to consider when developing your retirement plan. Working with a qualified financial professional can be beneficial in striking the right balance between your need for investment growth and your personal tolerance for risk. Schedule regular reviews with a financial professional to ensure your investment plan is on track to meet your lifestyle and income needs throughout retirement.

Here are some flexible access to money options. Any amount you contribute to your Roth IRA can be withdrawn without incurring taxes or penalties, at any time and for any reason. Consider this a source of financial flexibility.

Fidelity Wealth Management offers timely news, events, and wealth strategies from top Fidelity thought leaders, providing valuable insights to help you navigate the complexities of wealth management. Before investing, carefully consider the funds' investment objectives, risks, charges, and expenses. Contact Fidelity for a prospectus or, if available, a summary prospectus containing this information. That way, your investment accounts are primarily funding discretionary expenses.

That can give you the flexibility to reduce spending from your investment accounts during market downturns, providing added comfort during volatile periods. Investing may help you reach your goals more quickly. Save as much as possible through 401(k)s, IRAs, and other retirement accounts. Consult with an attorney or tax professional for personalized advice regarding your specific situation. Remember that investing involves risk. The value of your investments will fluctuate over time, and you may experience gains or losses.

Fidelity Brokerage Services LLC, member NYSE, SIPC, located at 900 Salem Street, Smithfield, RI 02917, provides brokerage services. Fidelity recommends maintaining at least 3 to 6 months of essential expenses in a cash emergency savings account. The ideal amount to have in your protection bucket will depend on factors such as your expected lifespan, planned retirement age, and desired lifestyle.

In the short term, extreme market conditions can create both challenges and opportunities. It is crucial to maintain a long-term perspective and avoid making impulsive decisions based on short-term market fluctuations. The key is to stay focused on your overall retirement goals and maintain a diversified investment portfolio that aligns with your risk tolerance and time horizon.

An annuity plan was merged into the retirement plan, which was renamed the retirement savings plan as of January 1, 2015. This integration simplifies the process and provides a more comprehensive approach to retirement savings. Always keep in mind that managing your own investments gives you control and flexibility to adapt to changing circumstances, ensuring a more secure and fulfilling retirement.

Retirement Planning Fidelity Investments Canada

Retirement Planning Fidelity Investments Canada

Fidelity Retirement Planning Tool High Level Model, Not Tactical